Do you know more about the Forex market? Do you want to get into the Forex trading? Or looking to get a depth understanding of currencies, charts, bulls & bears, short selling, and much more? You need to get a depth learning of Forex trading and pick up the high-performance skills and techniques to be proficient in starting trading like an expert in the Forex market. And all these will come true once you accomplish the Udemy best-selling Forex course named Forex Trading A-Z™ – With LIVE Examples of Forex Trading. This course is a top-rated Forex course on Udemy, who has been enrolled by over 40,304 students. And most of them are very satisfied with what they learnt.

Time to learn the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course now? Click on the below button to get up to 95% off using Udemy coupon.

Take This Course Now for 95% Off!

The Forex Trading A-Z™ – With LIVE Examples of Forex Trading course is created in a collaboration with the data scientist of Kirill Eremenko and the Forex trading academy of ForexBoat team. The course will teach everything people need to know to be an expert in doing Forex trading. So, if you’ve been always looking to get a full understanding of how the Forex market works and on how to take full use of the currencies movements to earn more profits, then the course highly recommended here is your choice.

The Forex Trading A-Z™ – With LIVE Examples of Forex Trading course comes designed with the 5.5 hours of HD video, 2 articles, and 55 lectures in total. And this course doesn’t require any prior knowledge of the Forex trading, so anyone can join the course although those ones who are complete beginners. So, if you are looking to learn all about the Forex trading, Forex charts, technical analysis, financial markets, and how to earn your money, then here is a right place to get started.

After the completion of the course, you’ll:

What is Forex? You will get a depth learning of it from the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course. Forex is a currency trading platform where all the currencies of the world are traded. Forex trading is also known as FX. The forex market is the biggest, most fluid market on the planet with a normal every day exchanging volume surpassing $5 trillion. The New York Stock Exchange (NYSE) trades in about 22.4 billion dollars every day, which is measly in front of the forex. Forex works round the clock and 5 days a week. It runs across banks, Organization, and individual people. Forex trading is a decentralized market place, unlike other centralized market places.

Forex trading usually involves two kinds of currencies because it’s a betting between the two different currencies. Consider EUR/USD, the most-exchanged money pair on the planet. EUR, the principal cash in the pair, is the base, and USD, the second, is the counter. When you see a cost cited on your stage, that cost is the amount one euro is worth in US dollars. You generally observe two costs since one is the purchase cost and one is the sell. The top eight currencies in the Forex market are the USD, EUR, JPY, GBP, CHF, CAD, AUD, and NZD. They are traded in pairs.

How does Forex work?

In the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course, you can clearly understand how the Forex trading works. There is a currency exchange rate through which the other currency can be exchanged. They always come in pairs like the USD/EUR which is by far the most common currency used in the Forex market. The exchange rate fluctuates based on different factors like economic and geopolitical happening. Inflation rate plays an important role in Forex trading.

A beginner at first might be doubtful about it and think it as a scam. Forex trading is not illegal neither it is a fraud scheme. The most important thing about Forex trading is to “learn”. The more you learn about the market and its fluctuation, the more you will earn. A beginner should never use real money without having good knowledge of Forex trading. To get a depth learning, the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course is a good start.

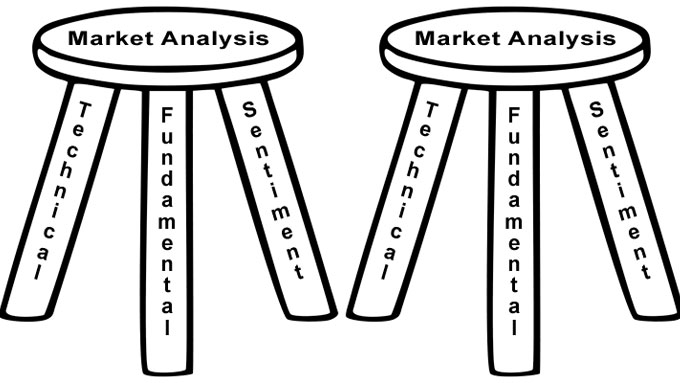

You’ll learn the types of Forex market analysis from the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course. Forex trading is all about learning. The more you learn about it, the more you will be able to earn money with it. Analysis of Forex market lets you know which type of trading you are required to perform according to the situation. The three most important types of Forex analysis are:

1.Fundamental Analysis

Fundamental, as the name suggests is understanding Forex through economics, social and political factors. By studying these factors, one can have an educational guess about the climbing or dropping of a currency. By applying the supply and demand phenomenon, the future prices of a currency can be found out. The only difficult thing in this analysis is to study the demand and supply factors. For example, if a countries economy is in rags, then its currency will probably fall.

2.Technical Analysis

Technical analysis is the study of price movement. The idea behind technical analysis is that the person looks at the history of price movements and predicts its future. By identifying patterns in the movement, future price of a currency can be assumed. The history determines the future. The traders bet their money on the phrase “History repeats itself”. Various types of Charts are used in the technical analysis of FX market. To learn more about the technical analysis, don’t miss out on learning the Udemy best-selling course – Forex Trading A-Z™ – With LIVE Examples of Forex Trading.

3.Sentiment Analysis

Sentiment analysis is the analysis where traders buy or sell currencies based on the “market feels”. There’s always an opinion of each trader whether a certain currency will go up or down. Combine these opinions and we get the “Market opinion”. The opinion of the traders is obtained through their trading. If there is an increase in the buying of USD/EUR, then the traders are of the opinion that EUR will go up and the value of Dollar will go down.

To master the difference between the Base and Quoted currencies, you need to learn the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course. For trading in the FX market, currencies must be traded in pairs. To know the value of a currency, you need one more currency to compare. These two currencies are known as “Base” currency and “Quoted” currency. The former is the base currency and the latter is known as the quoted currency.

The base currency’s value is always one. By the value of the base currency, we can assume the price of the other currency. 1 unit of base currency can tell how it fairs against the quoted currency’s single unit. Taking an example will help you understand easily. Let us take the pair USD/JPY. The quotation currency of this pair is 1.10 Yen. After a few minutes, the value increases to 1.40 Yen. This means that the dollar lost .30 value against Yen and Yen got a bit stronger against the dollar. It basically tells how much a 1$ can buy Japanese currency Yen.

A Forex trader would buy a currency pair only when he expects that the value of the base currency will increase against the value of the quoted currency. In the same situation, a currency trader will sell his currency pair if he thinks that the value of the base currency will decrease against the quoted currency.

FX trading is the process of buying and selling currencies simultaneously. When a trader buys a currency pair, they buy the base currency and sell the quote currency. There are two prices listed in FX trading. The ‘Bid’ and the ‘Ask’ price. The bid price is when a trader can sell his base currency simultaneously while buying the quote currency at the same time. The ‘Ask’ price is when a trader can buy the base currency while selling the quote currency at the same time.

Meta Trader 4 is an online foreign exchange platform. It is used as an FX market trading platform, you’ll learn more about from the Forex Trading A-Z™ – With LIVE Examples of Forex Trading course. Meta Trader 4 has a comprehensive strategy for you to apply before trading. These strategies if understood properly can gain you a massive amount of money in a period of time. Meta trader 4 became quite famous during 2007 till 2010 among various traders. They started using it as their secondary trading platform due to its popularity among other traders. Some of the most helpful strategies in Meta Trader 4 are:

Analytic Functions – The analytic function provides interactive charts with 9-time frames. This lets you keep an eye on various currency pairs at the same time. 30 technical indicators are also provided in analytic function with 23 analytic objects. These technical indicators coupled with the 23 analytic objects make the task easier.

Trading Signals and Copy Trading – If you don’t have enough knowledge about Forex trading, it’s really not a very big problem. The Meta Trader 4 lets you copy the buying and selling patterns of other traders at a certain price. Trading signals can also be bought through meta trader 4. Even a busy person can trade currencies with the help of copy trading. You need to be careful before copying your trade from another user. Make sure that the person you are copying has a good percentage of winning.

The Meta Trader Market – The Meta Trader market is the place where you will find news about a currency, get an expert opinion on a currency. The meta trader market also provides the newest type of technical indicator. In the meta trader market, trading robots are also for sale. Trading robots predict the future of a currency through various types of algorithms. These 3 features are the fundamental features of meta trader 4.

In this Forex Trading A-Z™ – With LIVE Examples of Forex Trading course, you’ll learn about how to manage Forex trading risks. Forex trading platform is a very challenging and risky market place. Here a trader needs to use his mind before trading rather than using his instincts. Trading in forex with instincts can be suicidal. Here are 4 tips to manage risks when trading in Forex.

Calculating your risk capital

You must know how much amount of money you are willing to risk in one trade period. If the profit is less than the risk involved then don’t stop trading at once. Wait for a day or two and then again start trading. Using a trading calculator can help you determine your risk capital.

A beginner should never trade aggressively

If you are a beginner in Forex trading, never trade aggressively. The first few losses can take your balance to zero. It means that the risk involved in the trades was too high. A beginner should start trading small and slowly increase their risk. This will let a beginner understand the marketplace and place trades accordingly.

Admit your faults

The most important rule in FX trading is to know when to stop. If you made a bad trade, then maybe it’s best to stop for a while and then start again. The human tendency is to turn a bad situation in a good situation by taking risks. In FX trading these tendencies can take traders balance to zero.

Never Trade after your risk capital is gone

Your risk capital is gone in the previous bad trades, what to do now? The best thing is to stop and wait for the perfect opportunity to come back. Your instincts will urge you to start trading again and regain your risk capital. Most of the times the traders tend to lose more money due to this.

Looking to be an expert in the Forex trading market? The Forex Trading A-Z™ – With LIVE Examples of Forex Trading course is a priority.

Discover more finance courses here:

Tips: How to get the 95% off Forex Trading A-Z™ – With LIVE Examples of Forex Trading coupon? Refer to an easy video guide as follows.